Unstoppable: The Next Chapter of Sustainable Finance

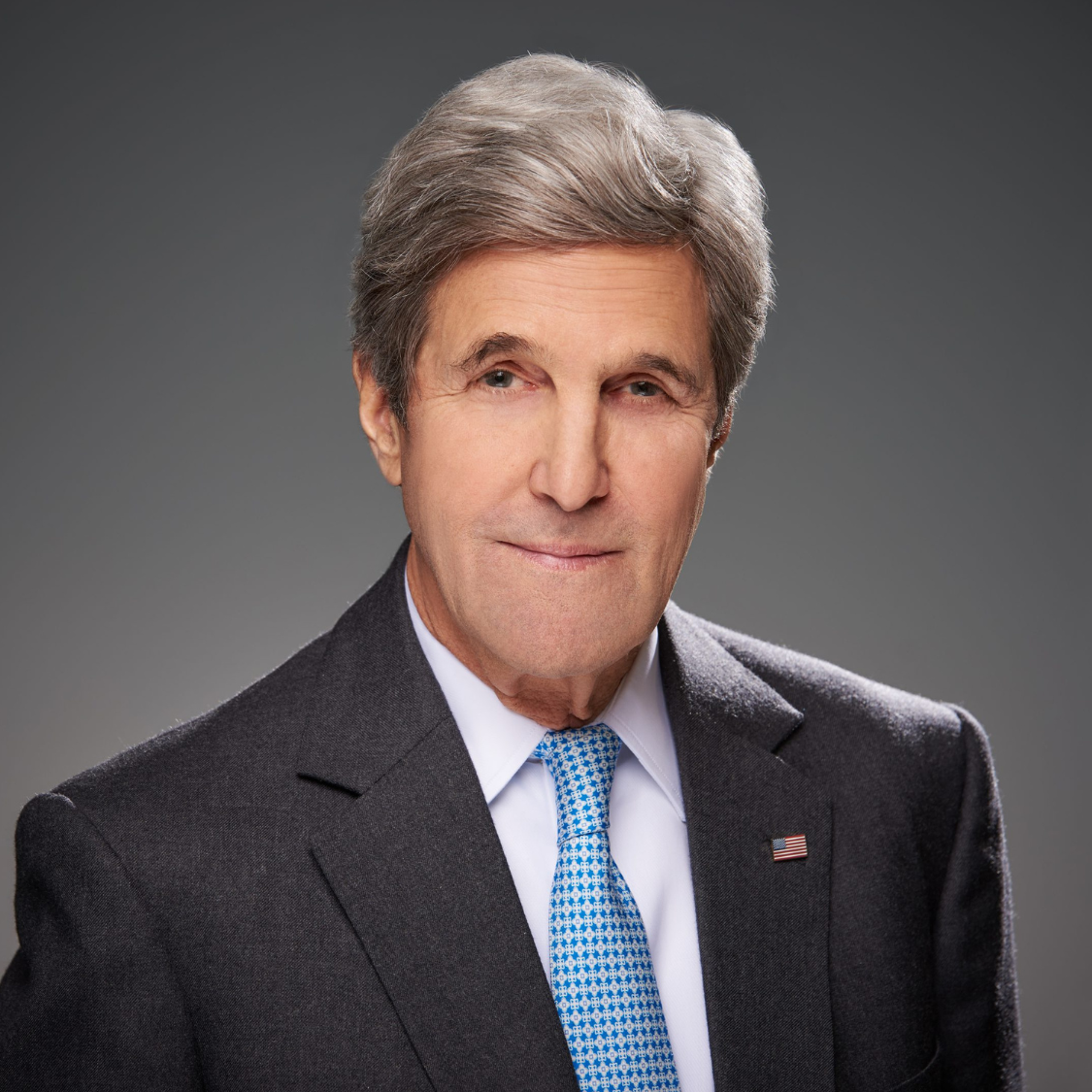

Season 3 opens with a frank look at the state of sustainable finance. John Kerry, former U.S. Secretary of State and Co-Executive Chair of Galvanize, and Rhian-Mari Thomas, CEO of the Green Finance Institute, join Patrick Odier, Chairman of Building Bridges, to discuss political headwinds, shifting narratives, and the credibility gap between ambition and investable pipelines. It’s a candid exchange on ESG’s polarisation, record investment in clean energy, and the urgent need to channel capital into early-stage solutions and emerging markets.

This episode is available as a special video edition — watch the full conversation on YouTube (Link in Resources) or listen below or on any major podcast platform.

“Something as morally compelling as saving the planet has been tarnished under the label of ‘wokeism’. The truth is, this isn’t about ideology — it’s about economics. New technologies beat old commodities. You can make money, do much better, and build a cleaner, safer world at the same time”

Episode guests

Beyond Returns: Fiduciary Duty in the Age of Sustainability

Fiduciary duty has long meant maximising financial returns. But as climate, nature and social risks reshape markets, that definition is shifting. In this episode, David Blood, Co-Founder and Senior Partner at Generation Investment Management, and Emmanuel Jaclot, Executive Vice-President and Head of Infrastructure and Sustainability at La Caisse, join Patrick Odier, Chairman of Building Bridges, to explore what fiduciary duty means in 2025.

They discuss how sustainability is becoming central to fiduciary responsibility, the balance between short- and long-term value, and whether ignoring sustainability could now be seen as a breach of duty.

This episode is available as a special video edition — watch the full conversation on YouTube (Link in Resources) or listen below or on any major podcast platform.

"If you don't include sustainability in your investment process, you are not fulfilling your fiduciary duty"

Episode guests

Nature in Finance: From Global Standards to Data Innovation

Carbon data is now deeply embedded in financial analysis. Nature and biodiversity, however, remain far more complex to measure, price, and integrate into decision-making — even as their material risks become increasingly evident. Because economic activity is fundamentally dependent on ecosystems, exposure to biodiversity loss reaches far beyond what many investors recognise.

Advances in data and analytics are now making these dependencies visible, while frameworks such as the TNFD are laying the groundwork for consistent disclosure across markets.

Hosted by Karen Hitschke, CEO of Building Bridges, this episode brings together Tony Goldner of the Taskforce on Nature-related Financial Disclosures (TNFD) and Vian Sharif of NatureAlpha to explore how global standards and data innovation are helping bring nature into mainstream finance — and what this means for investors managing risk and identifying new opportunities for resilience and long-term value creation.

"We really need to start looking at nature as a driver of risk and resilience in portfolios"

Resilience in the Built Economy: From Real Estate to Risk Management

Hosted by Karen Hitschke, this episode examines how climate and financial risks are reshaping the built economy — from buildings to infrastructure to entire cities. Extreme weather and rising insurance pressures are exposing vulnerabilities, forcing developers and insurers to rethink how resilience is designed and priced.

Harrison Méan of Swissroc outlines what retrofitting, adaptability, and shifting usage patterns mean for the future of real estate. Linda Freiner of Zurich Insurance explains how climate modelling, data, and early risk prevention are transforming insurance and determining what remains insurable — and therefore investable. Together, they explore how finance, design, and risk management can align to build assets and cities that withstand the shocks ahead.

“If we do not invest in risk prevention, in adaptation and in resilience, insurance prices will go up”

Episode guests

Building a Nature-First Economy with Integrity

As nature becomes a central factor in economic stability and long-term value, investors are rethinking how ecosystem health shapes risk, resilience and growth. Rising disclosure expectations and mounting scientific evidence are pushing nature firmly into mainstream financial decision-making.

Marc Palahí, Chief Nature Officer at Lombard Odier Investment Managers, explains why nature is now financially material and where opportunities are emerging across regenerative agriculture, sustainable forestry and circular bio-based value chains. Margaret Kim, CEO of Gold Standard, brings the integrity perspective, outlining how strong baselines, standards and verification make nature-based solutions credible and investable. Together with host Karen Hitschke, they explore how science, finance and governance can converge to build a nature-first economy grounded in measurable impact and long-term resilience.

“The greatest business opportunities of the 21st century will emerge from nature, nature-based solutions and circular bioeconomy supply chains — all rooted in nature”