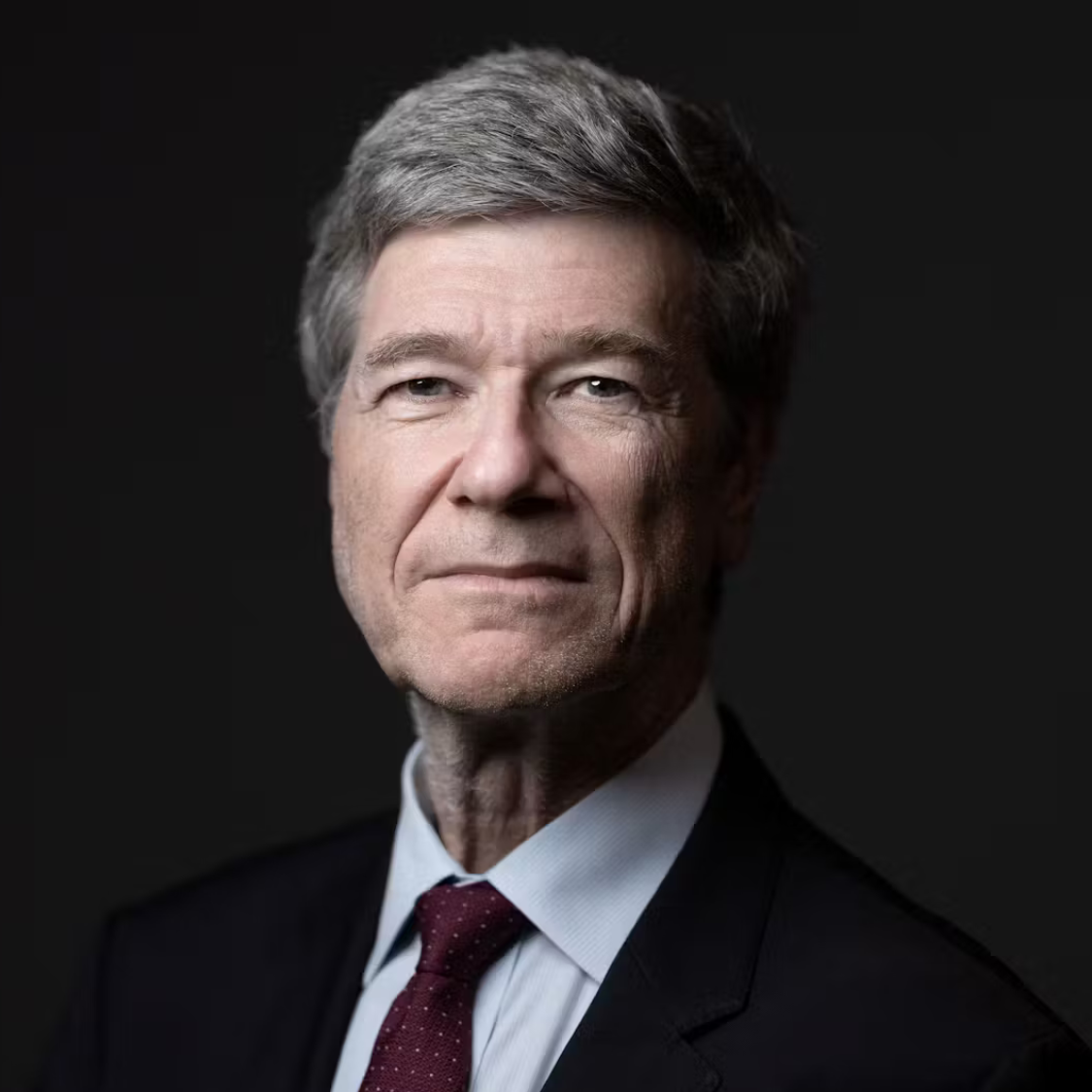

Development as an Investment Challenge: Jeffrey Sachs on Financing the Future

Development is often framed as aid, but for Jeffrey Sachs, one of the world’s leading development economists, it is first and foremost an investment challenge.

In this opening episode, Professor Sachs explains why development finance must be rethought around long-term capital mobilisation rather than short-term assistance. He explores why private money still avoids poor economies, how entrenched risk perceptions distort investment flows, and what policy shifts could unlock capital for the countries that need it most.

Looking ahead to 2030, Professor Sachs outlines what an investment-led model of sustainable development might look like, with governments, international institutions, and private investors working together to finance the Sustainable Development Goals at scale.

"My view is that the private sector could provide the financing, but we need a different approach, a different understanding, a different economic framework"

Inside the Engine Room: Mobilising Capital for People and Planet

Impact investing is an important component of the broader sustainable finance ecosystem needed to close the $4 trillion SDG financing gap. Yet despite its promise, it still accounts for only 1% of global assets. The question is how to scale it to the level the world urgently needs.

In this episode, Guillaume Bonnel, CEO of the SDG Impact Finance Initiative (SIFI), unpacks the barriers that have kept impact investing from growing beyond its niche. He discusses the structural challenges that limit investor participation, the perception of higher risks in emerging markets, and the need for stronger pipelines of investable opportunities.

The conversation also explores how blended finance can provide the missing link by using catalytic capital to de-risk investments and attract institutional money at scale.

“Finance was once at the service of the economy — not an end in itself. We need to reorganise our system so that capital again flows into solutions that benefit society.”

Catalytic Capital Meets Impact Investing: Making Purpose Investible

To truly scale, impact investing must be designed for resilience, credibility, and investor confidence — not just aspiration. In this episode, Nicolas Muller unpacks how to design investment vehicles that deliver both measurable impact and market-rate returns, while meeting the expectations of commercial investors, donors, and local partners alike.

From building diversified portfolios that withstand macro shocks to structuring funds in ways institutional investors trust, Nicolas explains what it takes to make purpose truly investible. He outlines the pivotal role of catalytic capital — whether through first-loss protection or technical assistance — in helping early-stage managers attract commercial investors.

“Catalytic capital should back innovative strategies that can scale but are too early to attract large asset owners — that’s where it’s most effective"

From Promise to Performance: A Reform Agenda for Blended Finance

Blended finance has long been seen as a way to mobilise private investment for sustainable development, but progress remains uneven. Systemic barriers continue to limit its effectiveness and scale. In this episode, Lisa Sachs, Director of the Columbia Center on Sustainable Investment (CCSI), shares insights from the 2025 report From Promise to Performance: Reforming Blended Finance for Scale.

Lisa breaks down the five structural challenges that are holding the field back — transparency, risk pricing, liquidity, pipeline gaps, and additionality — and why tackling them is essential if blended finance is to live up to its potential. Beyond diagnosis, the conversation looks at practical reforms and the role that institutions from rating agencies to DFIs and donors can play in improving market efficiency. The discussion ultimately points to a path forward for blended finance to deliver greater impact where it is needed most.

"Emerging markets are not inherently risky. They're risky because we say they are. With the right safety nets and de-risking mechanisms, we could unlock finance at scale"